Did you know businesses lose, on average, 5% of their revenue each year to occupational fraud? This very real threat is lurking inside many organizations, with fraudsters silently siphoning away profits. The danger comes in 3 primary flavors: asset misappropriation, balance sheet fraud, and corruption. In the case of balance sheet fraud, think Enron. This type of fraud aims to deceive shareholders by cooking the books to hide financial activity or shortfalls. The average case results in $766,000 in losses, yet the complexity involved makes balance sheet fraud the least common type at only 5% of cases.

Asset misappropriation might as well be called theft on the job, accounting for 89% of cases. It's much easier to get away with, which is why asset misappropriation is the #1 type of occupational fraud. From stealing inventory off the shelves and skimming petty cash to more sophisticated schemes like ghost employees and AP fraud, an energy company's bottom line can be chipped away a little at a time without robust controls, resulting in an average loss of $120,000.

Corruption aims to use one's position and power for personal advantage and, not surprisingly, overlaps with almost 50% of other types of fraud. Someone abusing their position isn't likely to hesitate to siphon funds through various schemes or cook the books to protect their misconduct.

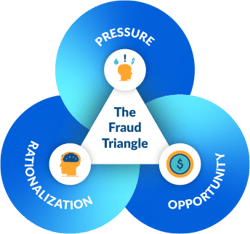

Like solving many crimes, the ingredients for fraud to occur boil down to understanding motive and opportunity. The Association of Certified Fraud Examiners expands on these two elements with a third component for fraud to occur: justification, which is the mindset that fraudsters have that makes their actions consistent with their own value system, i.e., the company owes me, so it's not wrong. When all three components of ACFE's fraud triangle exist - motive, opportunity, and justification - the stage is set for someone in your organization to engage in occupational fraud.

Strategies to Combat Occupational Fraud

To combat occupational fraud, energy companies should adopt a two-pronged strategy, starting with a proactive defense. To begin, if your oil and gas accounting team is not using a positive pay file, call your bank today and get the ball rolling. It's such a powerful tool, yet many teams either put off setting up positive pay or argue that their accounting department only has one overworked employee. Even a small operator can send out hundreds or thousands of checks per month. By using positive pay-on-check deposits and ACH transfers, your bank is the first line of defense for preventing external thieves from forging checks and internal fraudsters from printing checks for themselves.

Next, implement controls and technology to separate roles and responsibilities. If one person has complete access to your accounting software, they can write a blank check and take it to the bank. No one person should be able to create, print, and approve withdrawals from your corporate bank account either by check or ACH. Ensure all security features of your ERP or accounting software are enabled and be sure to encrypt signature files and only update with an approval process.

Though more of a reactive strategy, your team should also set up policies and procedures to actively find fraud inside the organization. 43% of fraud cases are uncovered by employees, so setting up a dedicated fraud hotline or e-mail address is a common best practice. Backstop this with periodic, unannounced internal audits to further protect your company's margins.

How The Pak Has Your Back

PakEnergy has worked with thousands of energy companies since launching our first oil and gas accounting software product in the late 1980s. Subsequently, we’ve amassed a deep understanding of accounting controls and security best practices, leading PakEnergy to staff our Pak Accounting team with finance and fraud professionals to drive deeper customer value. Our Certified Fraud Examiners have your back by ensuring Pak Accounting has the right features to protect your assets and working with customers to uncover and prevent fraud.

Our annual SOC 2 Type II audit provides the assurance of an unbiased third-party auditor that our digital infrastructure, cloud architecture, and security controls meet the highest standards. This ensures that neither external parties nor employees can hack the system for their own advantage.

Approver Controls Protect Assets

Pak Accounting provides industry-leading features to proactively prevent occupational fraud, including positive pay. Our users can easily export positive pay files in more than 80 formats unique to major banks and their branches. You can also rapidly build custom positive pay files with the help of PakEnergy's product experts.

Pak Accounting also delivers granular user access and permission controls, making it possible to create separate roles and responsibilities so no single user has the power to do everything. Plus, the system delivers the latest two-factor authentication, encryption, and signature file access control to safeguard financial and personally identifiable information (PPI), such as social security numbers.

Finally, Pak Accounting allows your team to set up financial controls how you want and in the best way for your business. You’ll also be able to monitor activity by exception with customizable alerts (e.g., a CFO will know immediately of unscheduled ACH authorizations or checks being printed over a specified amount).

With the fast pace of operations and development across US basins, oil & gas teams are busier than ever, creating fertile ground for fraud to grow. Switch to Pak Accounting software to automate fraud detection, safeguard your assets, and increase confidence in financial controls. Watch our "Occupational Fraud & How To Prevent It" webinar to learn more.

Are you doing enough to shield your business from occupational fraud? Understand the red flags and get tips to help protect your assets with our exclusive fact sheet »

Elizabeth A. Hutton, CFE serves as Product Director for Pak Accounting’s upstream software, where she brings her oil and gas accounting, fraud, and technology expertise to design new capabilities and oversee product road mapping, integrations, and implementations. A Certified Fraud Examiner with a Master of Science in Forensic Accounting, Beth conducts fraud investigations and works directly with customers to enhance their risk mitigation practices. An expert in the field, she works to stay on top of current occupational fraud tactics and trends to continually augment PakEnergy’s fraud protection capabilities. Beth is a frequent speaker in the industry and is an active member of the Association of Certified Fraud Examiners and the Council of Petroleum Accountants Societies.