The IRS is initiating tax legislation effective April 1, 2020 – December 31, 2020, that will allow companies to take Families First COVID-19 credits against Paid Leave, Paid Sick Leave, and Child Care Leave due to the COVID-19 virus if the company and employee qualifies.

WolfePak Software is responding to this as quickly and efficiently as possible by implementing the ability for our clients with the Payroll Module to easily have the necessary information for reporting purposes. WolfePak will provide this information in a report allowing for clients to easily determine the amount of credit that can be taken. We highly recommend that when it is time to report these credits that you seek the help and guidance of your CPA or tax advisor.

The remainder of this blog post contains the instructions to implement these steps to enable this reporting. Please feel free to download this PDF for a printout of these instructions.

In order to easily allow the report to determine the information for your company to report tax credits, it is important to follow the directions below.

SETUP:

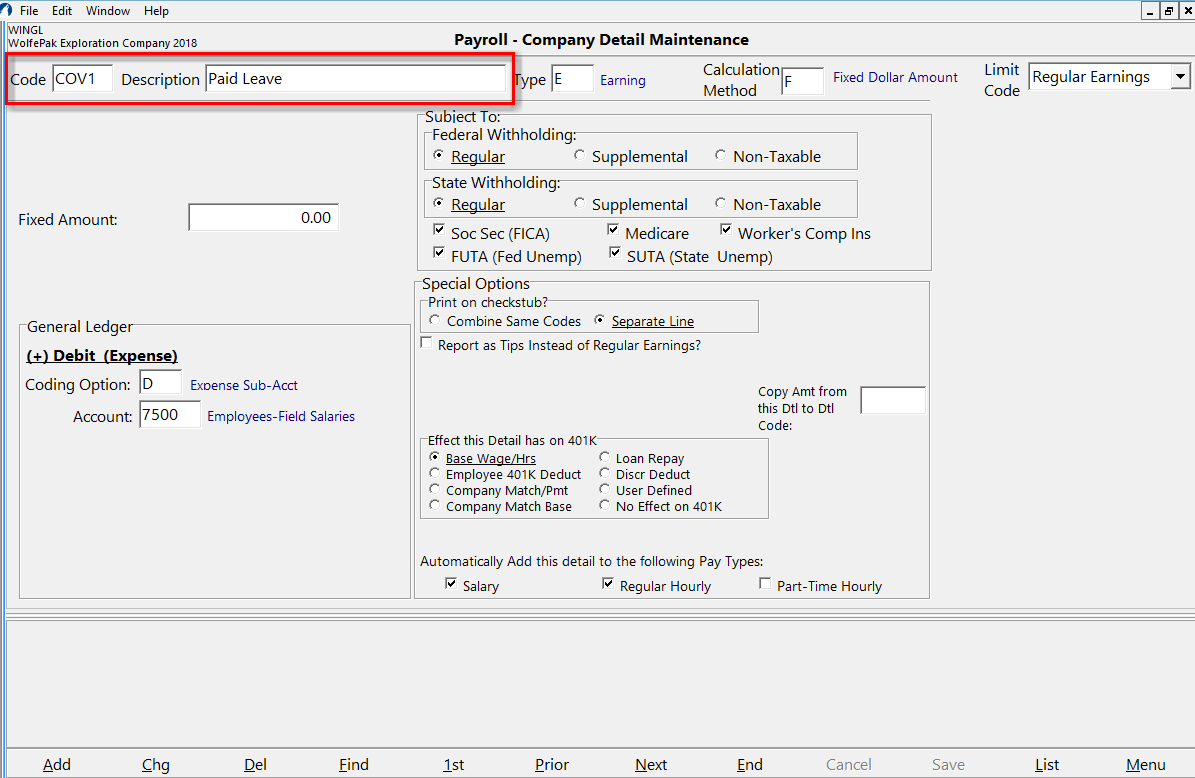

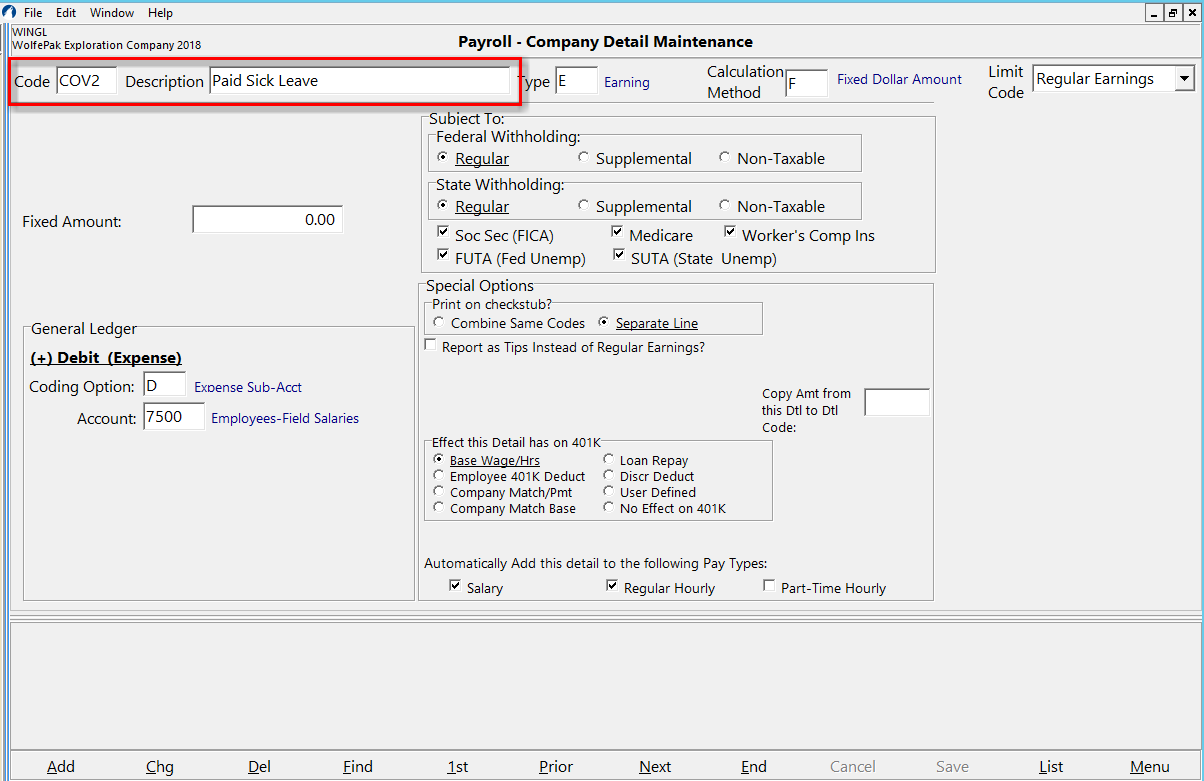

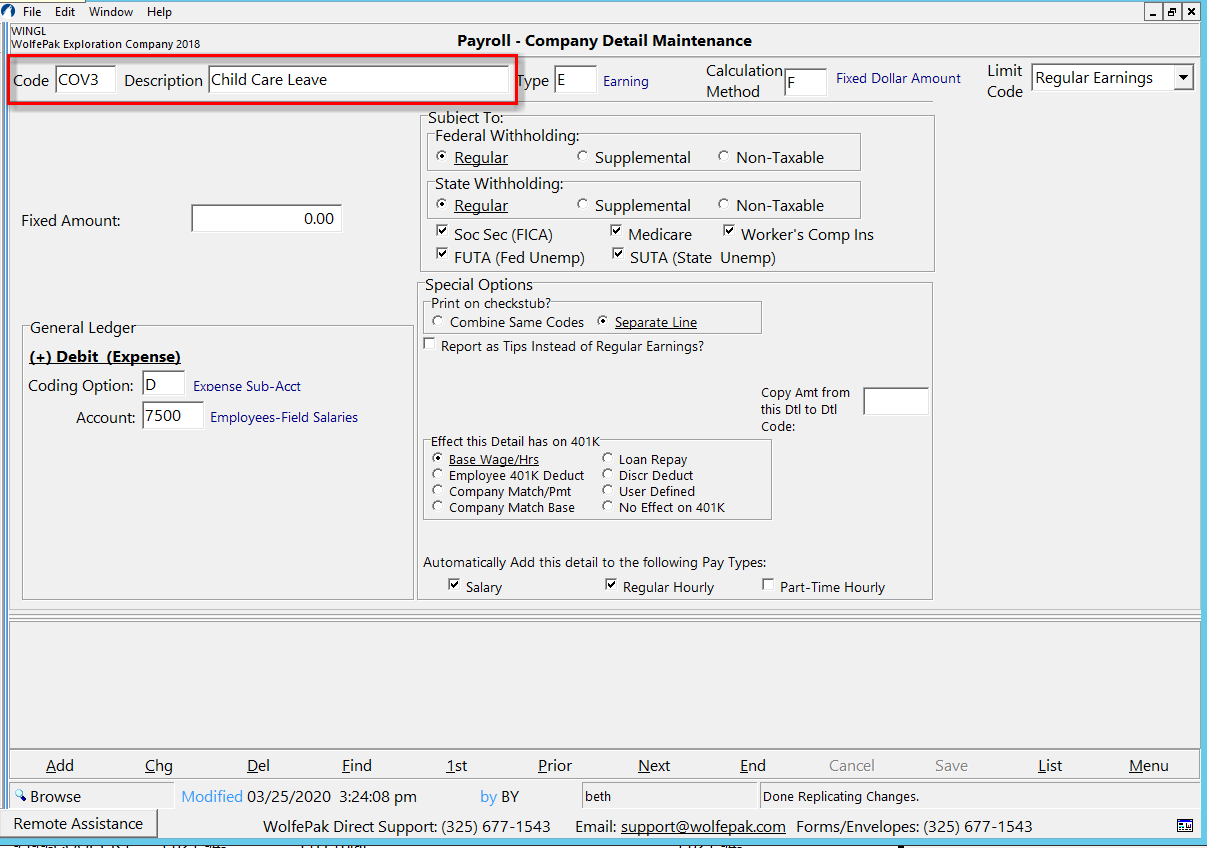

There will need to be separate detail codes set up to track the pay for the different leave types. The three new detail codes must be defined as seen below:

| Paid Leave | COV1 |

| Paid Sick Leave | COV2 |

| Child Care Leave | COV3 |

Please set these detail codes to be taxed as the employee would normally be. This will allow for all paid dollar amounts for the employee and employer to be tracked easily and for the implemented programming for the report to properly populate the different dollar amounts.

***NOTE*** WolfePak recommends that you consult your CPA or tax advisor for help in determining the amount of tax credit your company is allowed to report. WolfePak will provide the necessary information to aid in this endeavor, provided the above instructions are implemented in your Payroll module, but will not calculate the credit to be taken. It is also the client’s responsibility to know if the company qualifies for the tax credits and to monitor the dollar/day limits as issued by the IRS. WolfePak’s Payroll module does have the ability to help you monitor the dollar/day amounts per employee by utilizing two fields on the tax credit detail codes at the employee level. However, it is imperative to monitor this on all employees taking COVID-19 leave to make sure IRS guidance is followed correctly.

Paid Leave Detail Code in Payroll > Basic Options > Detail Codes

Paid Sick Leave Detail Code in Payroll > Basic Options > Detail Codes

Child Care Leave Detail Code in Payroll > Basic Options > Detail Codes

Fields to help monitor dollars/days per employee:

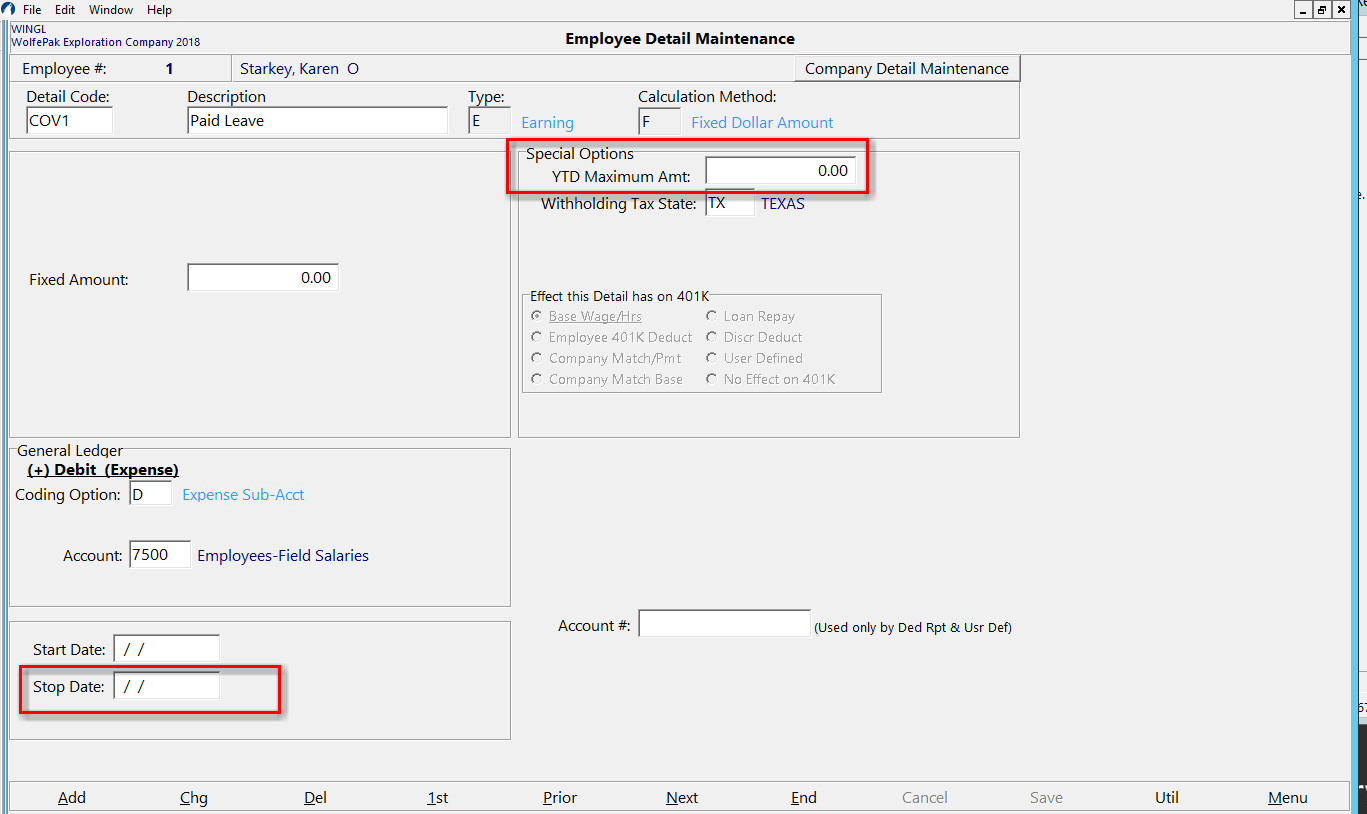

The applicable detail codes should be added to the employees that are taking the leave. To help keep the dollar/day amounts within the IRS guidelines, it is a good idea to use the Special Options > YTD Maximum Amt field and/or the Stop Date to help stay within IRS regulations. These tools are available to help monitor but each employee taking COVID-19 leave will also need to be reviewed to ensure IRS compliance.

WolfePak will implement programming for the new report and notify you in a timely manner in order for your company to be fully prepared to report the credits to the IRS. Instructions for the report will be provided for you and your Customer Success Team will be available to answer questions. We appreciate the opportunity to serve our WolfePak family in these uncertain times.